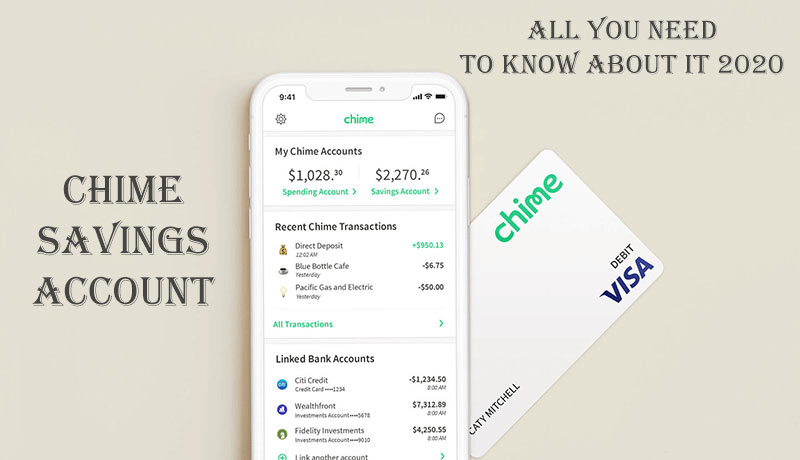

Chime Savings Account: All You Need to Know About It 2020

No matter where you live in the world. To manage money the importance of a bank account is insurmountable. With the progress of time, the way of banking has also changed. As a result of continuous transformation, online banking has set in the core of the finance system. As we are talking of online banking services, it is important to mention that in the US, Chime bank is counted among the top in the list of the best, fast, and reliable banks. And there are many reasons to support this claim. Among so many cool features, the Chime savings account is the one that has earned a ton of appreciation.

Moreover, Chime's direct deposit, Chime visa debit Card, Chime credit builder credit card, and hassle-free spending account services are some other value-added features. In my previous posts, I have explained all the above-mentioned features of Chime. You can read them and educate yourself.

From the heading of this post, you might have got an idea about what we are going to discuss. More exactly, this helping post is going to let you know the answer to some basics such as- How do I access my Chime savings account? How does a savings account work in Chime?

Before I proceed, it is worth noting that the Chime savings bank account is free to open. It means you don't have to pay for anything. If you are just a citizen of the US and have SSN, you can open a savings account on Chime. Also, be informed that once you sign up for Chime, you become eligible for a savings account as well. It means, no bothering formalities.

So, now as we always do, let's start with some basics:

How can I use my Chime savings account?

As the name implies, a savings account is an account that one creates to store money for the mid and longer-term. The simple idea that goes along with the savings account is to just save money for a pre-decided time period and earn regular interest. The best part of having a savings account on Chime is that it lets the users deposit money according to their requirements. Moreover, what I have personally liked is the fact, there is no minimum balance requirement. In short, the primary use of the savings account in Chime is to store money and earn interest.

How to open a Chime saving account?

To open a saving bank account on Chime what you have to do is just create an account on Chime. Once you complete the sign-up procedure, you will get an option to set up a savings account. These are the steps to follow to create a Chime bank account.

- First, install the Chime app on your phone.

- Now simply type your complete name in the given field.

- Then, type the email address in the given column.

- Now enter your phone number.

- Also, share some personal information such as date of birth, address, Zip code, and SSN.

- Further, select your occupation from the drop-down menu and also select the source of your income.

- In the next column, select the range of your income, tap the next button.

- Now select all the boxes to accept terms and conditions and tap the submit application button.

- The next screen will open up with a showing tab for setting up your "Chime Savings Account". On the same screen, you can enable Chime direct deposit.

What is the Chime savings account Interest rate?

Chime's savings account offers 1.00% APY (annual percentage yield) to the users. According to the experts, 1.00% APY is no maximum but better than many traditional banks. However, in comparison to many other online banks, 1.00% APY is quite normal.

Can I withdraw money from my Chime bank saving account at an ATM?

Sorry to say but the reality is that you can't withdraw money from saving accounts at an ATM directly. What best you can do is to transfer money from your Chime saving account to spending account and then with the help of Chime Visa Debit card, you can withdraw funds from your Chime bank account.

What are the reviews for the Chime savings account?

Chime savings account reviews are a mixture of both pros and cons. Features like no monthly fees, no overdraft fees, and early access to direct deposits are appreciable. Also, Chime offers a large ATM network.

On the other hand, some drawbacks like poor savings rate, limited services, difficulty to make cash deposits, and out of network ATM charges are factors that contributed to the negative reviews of Chime Savings accounts.

Final Say

So, in conclusion, we can say that the Chime savings account can be a top choice for people who are looking forward to managing their money with a safe and simple banking system. If your requirements are not so big and sophisticated, you can get along with the Chime bank account.